38% Net Margin, PE 8, 21% growth. Kaspi is my biggest holding.

A rare combination of quality with a deep value price.

Key Features:

Monopolistic characteristics.

Capital-light business model with multiple moats.

Solid Growth: Revenue growth of 21% last quarter (5 year average >43%).

Cheap Valuation: PE Ratio: 8, EV/EBITA 4.3, PEG 0.5, Earnings Yield 13%

High Margins: 83% gross margins, 70% operating margins, 38% net margin.

Great Balance Sheet: No net debt.

No dilution: Shares outstanding have remained stable.

Dividend: Recent dividends with 6-8% yield, but Kaspi is now re-investing capital for further growth instead of dividends.

Disclaimer: This article is for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.

At first glance, Kaspi (NASDAQ: KSPI) looks incredible. High margins. Healthy revenue and earnings growth. High returns on capital. Yet, it is priced as a bargain-bin deal that is expected to go out of business. This is my absolute biggest holding.

Most of the time, investors must choose between a poor business that is cheap (i.e “cigar butt”) OR a highly profitable and growing business with an expensive valuation (i.e a “high quality” stock). Kaspi is one of the few cases where you can have the best of both worlds. This type of opportunity is very rare.

That sounds lovely. But what is the catch? What are we missing?

Whenever something seems too good to be true, we should pump the brakes and look for underlying risks. The most obvious risk is that Kaspi operates in a fairly unknown market, the central-Asian country of Kazakhstan. This is not just an emerging market, this is a “frontier market.” We are real pioneers here… Luckily it is listed on the NASDAQ. For some investors, this fact alone may be enough to make them uncomfortable and disregard Kaspi. But this market discomfort can lead to mis-priced opportunities for those willing to venture outside the warm comforts of the S&P500. Although the road may be bumpy and winding, the course of history shows that most countries move towards modernization over time. Spending power tends to move upwards. Kazakhstan is a country that is firmly moving towards digital modernization, and Kaspi is the country’s tech poster child. Kaspi has distributed high dividend payments for years, which should re-assure foreign investors that real cash is being generated in this far-off land.

We will discuss specific near-term headwinds and nuanced risks with this position later on. For now, let us understand how Kaspi operates.

Kaspi’s unique business model:

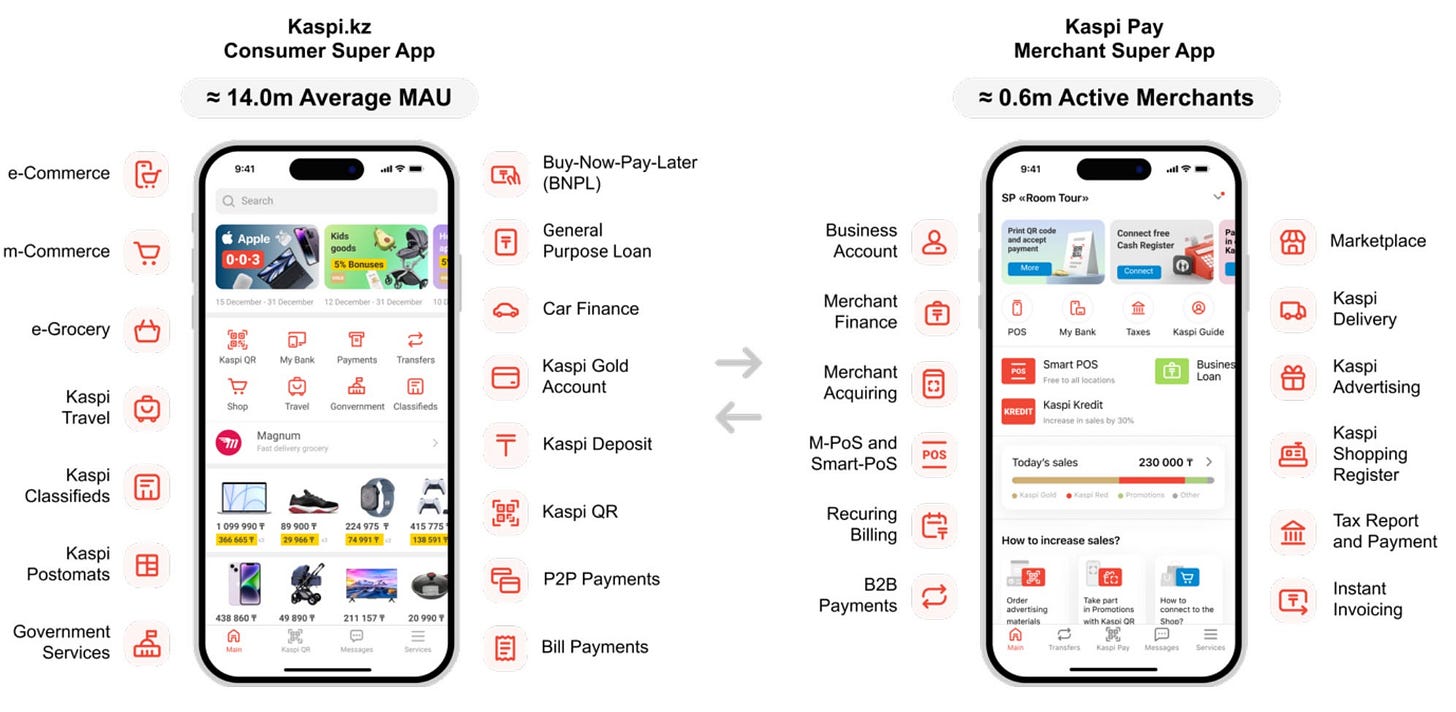

Kaspi operates a two-sided “Super App” model, one app for consumers and a separate app designed for merchants. The idea of combining multiple functionalities in one app is not a new concept and some examples can be found around the world. Mercado Libre (MELI) in South America and Sea (SE) in South-East Asia offer both payment services and their own marketplace. The famous WeChat app in China (Tencent, 0700.HK) is even more extensive. It weaves together social media, messaging, gaming, payments and a subcategory of mini-apps. Yet, I would argue that there is no app that has a more encompassing platform than Kaspi in its domestic market.

Main segments:

1. Payments Platform: Facilitates digital payments.

QR and mobile payments for consumers and merchants. Utility bill payments, taxes, and fines. E-wallet and peer-to-peer (P2P) transfers. PoS merchant device.

Monetization: Transaction fees from merchants (Kaspi Pay) and service providers.

19% y/y revenue growth in fiscal 2024, 16% growth in 1Q 2025.

2. Marketplace Platform: 3P E-commerce platform services and classifieds.

Online shopping for goods (electronics, apparel and groceries), Kaspi Travel (booking of flights and hotels), car trading (kolesa.kz) and real estate listings (krisha.kz). Smart Logistics is also included in this segment.

Monetization: Commissions on sales, advertising services, and logistics.

43% y/y revenue growth in fiscal 2024, 33% growth in 1Q 2025.

3. Fintech Platform: Digital lending and banking services.

Consumer loans, installment plans, and BNPL (Buy Now, Pay Later), deposits and current accounts (Kaspi Bank), credit cards and other banking products.

Monetization: Interest income and service fees.

26% y/y revenue growth in fiscal 2024, 18% in 1Q 2025.

Kaspi seamlessly blends commerce (marketplace, auto trading, classifieds, groceries and travel) with digital payments and consumer banking. Kaspi supercharges its commerce by lending to both consumers and merchants to cover short-term liquidity challenges. The app even facilitates many government services for free! You can get a wedding license on the same app that you book a honeymoon vacation on. You can buy a car on the app and then get a car loan from the Kaspi bank. One of the company’s talents is there ability to expand to new verticals, finding more and more ways to engage 15 million Kazakh citizens that use its app. For example, e-groceries is experiencing rapid scaling (64% GMV growth y/y, almost 1 million customers in 2025). Kaspi is an app that is used every day and improves the lives of its users.

Their overall business is digital and capital light, as evidenced by incredible margins. This extends to their smart logistics platform, where they outsource deliveries to a network of couriers.

“So, if we look at the value chain of our logistics platform, we have taken the view that in order to deliver the parcels to consumers from merchants you don't really have to own that many assets… we are building the platform which manages the entire network. It gets all the people and the entities participating in the value chain (to) actually connect.”

- Mikheil Lomtadze (CEO)

The logistics system involves printing a Kaspi label, using AI-driven technology to create the most efficient route for the package, and maintaining relationships with couriers to manage the delivery. Transportation is outsourced. In terms of physical presence, they have delivery stations in the larger cities for couriers to drop off parcels and a large network of post-mats for consumers to pick up the packages. Post-mats are a cost-effective investment as they reduce the need for expensive last-mile delivery, particularly in a country with one of the lowest population densities in the world. 47% of orders are delivered in <2 days. For the e-grocery business, they have opened “dark stores” in major cities to increase delivery speed for perishable items, similar to Meituan (3690.HK) in China.

Overall, this is an incredible business model.

Their two sided commerce app for both consumers and merchants creates a synergistic effect with high engagement in their ecosystem, a classic flywheel. They continuously offer new services through their app and users become accustomed to using Kaspi everyday. The stickiness of this ecosystem provides a formidable moat against any competition. The ratio of daily active users to monthly active users (DAU/MAU) is a measure of app “stickiness” and engagement. Kaspi’s 68% DAU/MAU in Kazahkstan is higher than that of Instagram or Facebook in the U.S..

Furthermore, the platform provides Kaspi with abundant consumer data for both advertising in their marketplace and reducing individual lending risk in their banking segment. This data can be used to improve the app in a self-reinforcing cycle. Their team of engineers have proven they have the technical skill to develop and launch more wide-ranging products than any local competitor.

Multiple moats:

Ecosystem of services on a single app: Users will find it inconvenient to find alternative service providers after learning to use the Kaspi app.

Network effects: Two sided e-commerce platform and a highly used payments app among consumers and merchants. Both of these products become more valuable as the user base increases.

Economies of scale:

Network of post-mats and couriers that improve delivery logistics.

Data advantage over competitors.

Their size allows them to hire the most talented employees for innovation.

Sizeable cash flow gives them operational advantages when acquiring new assets.

Brand Moat: Brand recognition of the Kaspi app is 5.5x higher than the next closest app according to KResearch Central Asia. Kaspi has 14.7 million users in a population of 20 million. This is amazing when considering the non-user population likely includes children or elderly people that are not tech-savy. They completely dominate their domestic market’s “share of mind.”

(A great example of an “ecosystem” moat is Apple, which I covered in a previous short article).

What is the growth rate and why is it slowing down?

I have spent a lot of time praising Kaspi’s competitive advantages, but lets examine the growth rate and why the market may be concerned. In the full fiscal year of 2024, revenue growth y/y was impressive at 32%. This slowed down to 21% in Q1 2025. For the rest of the year, management has further lowered their guidance to 15-20% revenue growth (excluding Turkey).

Why was the guidance lowered? Management offered several explanations for the slow down:

A new law was passed, requiring the registration of smartphones. This resulted in higher prices (phones have to be regulated) and decreased demand as ‘counterfeit’ phones are taken off the market. Phones account for around 18% of e-commerce volume. Kaspi’s management estimates the marketplace revenues were reduced by ~7% due to this law. The impact on demand is anticipated to be temporary over the next few quarters.

Interest rates: Higher national bank rates to combat inflation will result in Kaspi paying higher deposit rate for their banking services. They aim to increase their deposits-to-loan ratio in the future, which will further increase these costs.

A new 10% tax on interest from government securities is being planned in parliament, along with higher reserve requirements. This is expected to affect net income by around 2% as per management. Kaspi does not hold a lot of these securities as it is a consumer bank with primarily transactional revenues.

A new tax code may increase corporate taxes from 20% to 25% for banking companies. Banking is about a third of their business.

This list of external factors is out of the company’s control. But even without the headwinds highlighted above, it seems their overall growth rate may be slowing down. The concern would be that they are running out of growth levers in Kazakhstan, which only has a population of 20 million people. Once they reach a mature phase in their home country we can still expect high returns on capital, but without the benefit of additional growth. This is why their expansion to Turkey is seen as a critical step in expanding their total addressable market, which will be discussed later.

What is the “real” growth rate…in dollars?

Astute investors will also point out that their growth is reported in the local KZT currency (called Tenge, with the symbol ₸). KZT has eroded significantly against the USD last year, losing 12% in 2024. Inflation in Kazakhstan remains high at 10% this year.

Although the company’s earnings in commerce/banking will naturally increase with inflation, future dividends will be paid out in USD. As outside investors, we must adjust our growth expectations for currency devaluation. If they are guiding for a slower 15% growth rate for the rest of 2025, then we can consider revenue to grow only 3% in USD-adjusted terms. The devaluation of the KZT against USD is at a historically high level right now; if the strength of the USD falls we can expect investors in Kaspi to benefit. Alternatively, if oil prices increase the KZT also tends to appreciate (there is a statistically significant correlation between the two) as Kazakhstan is a big oil exporter.

How is the market pricing Kaspi right now?

Traditionally, a company with a PE of 8 is expected to have 0% growth. Depending on the industry and the interest rate environment, investors generally expect— at minimum— to “get their money back” within 8 years (9% CAGR). The S&P500 has returned about 9.33% on average over 30 years and serves as a useful benchmark. A company with high returns on capital, a defensible moat and a pristine balance sheet can command a much higher multiple.

Kaspi has a PE of 8, which means the market is pricing it for 0% USD-adjusted growth (12% growth in KZT terms). If Mr. Market is correct and there is no real growth (in USD terms), investors still own a dominant business that can keep up with local inflation and provide a 13% earnings yield. Not too bad.

I believe the probability of an upside scenario is much higher. Kaspi has the ability to re-accelerate its growth rate and the market may then realize a higher multiple was warranted all along. I won’t be late to that party.

Where will long-term growth come from?

“We believe the business we have built in Kazakhstan is just a remarkable business model which we would like to bring to other markets. And I think even our consumers are asking us and the country is asking us, can we go outside of Kazakhstan?” - Mikhail Lomtadze (CEO)

While Kaspi has built and incredible platform in its home country, investors have questioned whether they could successfully replicate this model in another country. For a long time, it was suspected that they would expand to another country in Central Asia such as Uzbekistan with its 35 million people. Kaspi already owned an auto classifieds website (Autoelon.uz) in Uzbekistan and showed interest in acquiring their Humo payment system during privatization. To my disappointment, they withdrew their bid for Uzbekistan’s Humo at the end of 2024.

Kaspi would eventually surprise investors with something even better. In January 2025, Kaspi acquired a 65.41% stake in Hepsiburada (HEPS), also known as Hepsi. This is a top e-commerce platform in Turkey, a country with a growing population of 85 million people! Hepsi is a hybrid 3P and 1P marketplace. They operate a last-mile delivery service called HepsiJet. Hepsi is the second largest online marketplace in the country, behind Trendyol which is owned by Alibaba.

Note: During fiscal year 2024, Hepsi and Trendyol had similar growth rates. Hepsi grew revenues by 11% (adjusted for inflation), while Trendyol had approximately 12% revenue growth (based on my calculations from data in the Alibaba 2024 Annual Report).

Entering Turkey has greatly expanded the addressable market for Kaspi. Hepsi has more users than Kaspi’s own market place, yet its GMV is 3x lower. There is a lot of room for improvement in transaction volume per customer. Accounting for the addition of Hepsi, Kaspi’s revenue is actually 18% higher in USD-terms. Turkish operations won’t be consolidated in its reporting until 2026.

Hepsi had improved its margins over the years and was briefly profitable in 2024, before earnings became negative again due to politically-driven consumption boycotts. Some value investors might say that this acquisition is an example of “di-worsification.” Why dilute Kaspi’s amazing margins with a less profitable marketplace? I think these commentators are missing the long-term picture. They are missing the forest for the trees.

Owning a Turkish e-commerce platform is a great start. The real prize is to re-create the entire “Super App” model in another country. A stand-alone market place does not have the ecosystem effect that made Kaspi so dominant. I was looking for signs that Kaspi was building up the financial side of the equation in Turkey.

The key moment would happen only 2 months later…

In March 2025, Kaspi signed an agreement to acquire Rabobank A.Ş (deal to close 2H 2025). This acquisition was essentially the purchase of a Turkish banking license. Kaspi has further explained that they intend to invest a further ~$300 million to fund their fintech strategy in Turkey, giving the bank its start-up capital.

Starting in 2026, Kaspi will be able to develop its payments and fintech technology in Turkey and integrate them with the Hepsi marketplace. I will point out that Kaspi quickly took most of the market share from Visa and Mastercard in 2019/2020, once they introduced QR digital payments. The take rate for a Kaspi QR payments is less than half the fee for a credit card transaction. If they can successfully re-create their entire app experience in Turkey, then they can spread to other emerging economies and the runway will be much longer than we think…

The exclusive portion of the article is for paid members who want to learn more about Kaspi. The article includes the following:

I estimate Kaspi’s market share in Kazakhstan and highlight Kaspi’s biggest local competitors in all segments (e-commerce, banking, digital payments).

I give an overview on Kazakhstan’s economic situation including general trends and the impact of tariffs.

Overview of management.

I investigate the impact of a planned “National Payments System” by the government (summer 2025). To assess the impact on Kaspi, I use analogous companies in a separate country that already has a National Payments System.