China has a consumption problem. It is stuck in a deflationary environment. China’s robust group of e-commerce companies will be beneficiaries of increased consumption in the future. I am picking a winner in this battle of tech titans. Let’s break it down.

Introduction:

While most developed nations have a service-based economy that is dependent on consumption, China’s economy is heavily skewed towards manufacturing and the export of finished goods.

China makes up 31% of global manufacturing. China’s factory output is bigger than the combined manufacturing of the United States, Germany, Japan, South Korea and Britain.

What happens when other nations impose tariffs on cheap Chinese goods? Many countries want to avoid flooding their market with “subsidized” Chinese goods and are turning to protectionist policies. Although the current Trump administration is known for its focus on tariffs as an economic and political tool, weariness of China’s exports started long before 2025. For example, Chinese electric vehicles were already tariffed under the Biden administration and separately by the EU and Canada.

Although exports to other countries have increased (the “Global South” is a strange term), they cannot fully offset the purchasing power of developed markets like the U.S. After the impacts of COVID and a real estate crisis, China continues to experience deflation while the rest of the world fights inflation.

What happens when China’s excess production capacity cannot be exported?

The solution: Turning inward.

Household spending accounts for less than 40% of China’s GDP, significantly lower than the international average of roughly 60% (this number is 70% for the U.S.). Boosting the consumption of its 1.4 billion citizens is becoming a key economic priority. Policy-makers are calling for “increased spending power” through purchasing subsidies. A policy of increasing domestic consumption will benefit the tech companies that have control over e-commerce in China, the worlds biggest e-commerce market.

The E-commerce Giants:

Alibaba:

The original e-commerce giant, Alibaba’s empire includes a formidable list of services:

3P retail (Taobao, T-mall and the wholesale site 1688).

Alibaba cloud (leading cloud provider in China).

International e-commerce (Trendyol in Turkey, Lazada in South-east Asia).

Smart logistics network (mostly out-sourced).

Local delivery (eli.me).

33% ownership in a major payment platform (AliPay).

Digital Media (a segment they are mostly exiting from).

Physical grocery stores (Freshshippo) and other buisnesses.

If you were to look at this company a few years ago, it seemed to be following the Amazon playbook. It was using revenues from its core e-commerce business to expand into cloud computing (similar to Amazon AWS) and into brick-and-mortar grocery store (like Wholefoods). Alibaba employed a more profitable 3P e-commerce model (Amazon does 1P retail), and they had less focus on building out logistics infrastructure compared to Amazon (which is arguably a moat).

Despite its undisputed leadership in Chinese e-commerce for a decade, Alibaba became a victim of its own success. The organization became bloated and turned into a stalwart. Revenue growth slowed as new fast-growing competitors appeared such as Pinduoduo (PDD) or social media companies like Douyin (the company behind Tik Tok). Alibaba began to lose its direction with a series of acquisitions (di-worsification) and constant changes in organizational structure.

A recently published resignation letter from a long-time employee outlined many of the issues that have caused Alibaba’s corporate culture to decay. The lack of clear strategy is reflected in the company’s performance:

Revenue growth has stagnated, while cash from operations has declined steadily for the last 3 years. The company has increased capital expenditure in AI and cloud servers, which has resulted in a 50% decline in free cash flow in 2024. There is no end is sight for these capex investments, which seem to only grow going forward. The company plans to invest $52 billion over the next 3 years in AI initiatives. Whether these heavy investments are justified (or even possible) is unclear to me at this point. This is certainly not a capital-light business anymore.

Quick Take: Alibaba’s current valuation (EV/EBIT of 11) is compelling and essentially values the company for stagnation, there may be upside if they are able to dominate cloud computing in China. However, I will not invest in a capital-heavy company that has been out-competed over the last 4 years. While it is still a large and formidable company, Alibaba began to lose its e-commerce moat many years ago. It is a victim of its own success.

JD.com

JD.com has a 1P retail model (similar to Amazon) with a bigger focus on branded-merchandise and more expensive items. JD.com's strength in electronics and appliances meant it was better positioned to benefit from government subsidies for those products. It has a large network of 3,600 warehouses, with a total area exceeding 32 million square meters. Some would argue this gives the company more of a physical infrastructure moat, with greater control of the customer experience. Due to its 1P model, JD.com is a low margin business. The narrow operating margin means income can grow rapidly with a fairly small change in operating efficiency.

Revenue growth has not been impressive over the last few years, but improvements in network efficiency have resulted in margin expansion. The excess operating cash flow has gone into buying more warehouses, so this model is a capital-heavy way of building a moat. Although JD has less optionality from a strong cloud segment, it has an even cheaper valuation than Alibaba with an EV/EBIT of 5.

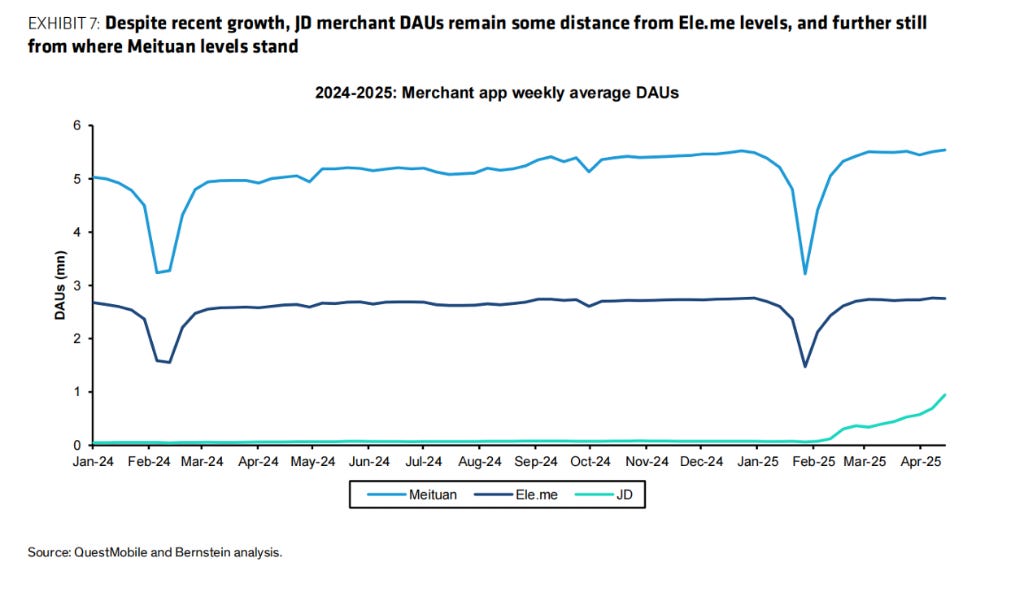

Despite the low valuation, the company’s recent moves are risky. JD has boldly entered the instant delivery space in an attempt to control the entire logistics chain (from production line to the consumer’s door-step). Competitor Meituan currently controls 70% of the food delivery market and has millions of local drivers. JD’s encroachement into Meituan’s territory (“instant commerce” and food delivery) has resulted in a costly price war. Companies are now competing with each other over who gets the mighty privilege of delivering food items within 30 min. JD hired a full-time army of 150,000 delivery drivers, attracting them with offers of social insurance benefits. JD also plans to offer $1.4 billion in consumer subsidies this year as it battles for a share of the market.

Meanwhile, Alibaba didn’t want to be left out of this blood bath and is investing $7 billion in its own customer e-commerce subsidies. These subsidies are clearly unsustainable in the long-term based on cash flow figures. Alibaba, JD and Meituan are engaged in a three-sided battle; as they attempt to bleed each other out of market share. Alibaba has the deepest pockets, but whether it can use its cash effectively is not clear. The irrational price war is now beginning to catch the attention of government regulators (at Meituan’s request).

Quick Take: Although the low valuation is attractive, I am not sure that JD will be victorious in its recent entry into instant commerce. While there is long-term potential in developing a complete end-to-end delivery network for all products, the risk of failure and capital loss is too high for me. Margins are already thin.

Meituan:

As described earlier, Meituan (HK: 3690) is an online shopping platform that focuses on locally-found consumer products and food delivery. Starting out as the largest food delivery service in China, Meituan was able to branch off into instant retail and a variety of other services. It now offers groceries, car-hailing, hotel booking, event tickets, bike-sharing and home rentals (like Airbnb).

Compared to Alibaba and JD, Meituan is a newer and rapidly growing company. Revenue growth increased almost 30% per year, while free cash flow was able to grow at an even faster rate due to margin expansion. As Meituan’s delivery network has expanded, it is clearly benefiting from higher economies of scale. The addition of new verticals has increased user engagement and the stickiness of its app.

This growth means investors will have to pay a premium over the other e-commerce players. EV/EBIT is 16. This premium is likely justified, as Meituan has higher growth rates and a higher return on invested capital. The ROIC has consistently improved, now reaching 18% (compared to Alibaba’s 8% and JD’s 10%). Although Meituan operates many of its own “dark warehouses,” it also cooperates with hundred of thousands of existing offline stores. By connecting these offline stores to the company’s digital platform, they can out-source a lot of inventory operations. This allows Meituan to expand in a more capital-light manner.

Quick Take: I admire Meituan’s expansion into new service verticals. It will be interesting to see if it can replicate its delivery model in its international expansion to the Middle East. These countries tend to have lower population density, which means local delivery networks will be less efficient. I am holding off on investing in Meituan for now as the price war may cause short-term pain. It would be an impressive feat if Meituan is able to hold onto its Chinese market share despite JD throwing money at mercenary delivery drivers. Meituan is on my watch-list and I may consider a small starter position this year.

PDD Holdings (Pinduoduo and Temu):

Finally, we have PDD Holdings which has flown under the radar in China’s domestic price war. While it may be avoiding costly domestic battles, PDD is expected to suffer from the international trade war between the U.S and China. Tariffs and changes to the “de minimis” policy threaten Temu’s U.S sales.

In my next article, I will explain why PDD is one of the most undervalued companies in the world. I will outline why changes in trade policies are not as significant as they seem. Growth rates will re-accelerate in the years to come. This is an innovative and highly profitable company, and yet it remains frequently mis-understood and mis-priced. Stay tuned.

- Stock Doctor

Disclaimer: This article is intended for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.

I dont know pdd that much, but being cautious on JD because you are not sure if they will win in instant commerce is like being cautious on IKEA because of the hot dog price wars. Irrelevant to the business. Pdd can't be more undervalued than JD.