Eagle Materials (EXP): Cementing outstanding returns

How I learned to love the (unloved) cement industry.

You might be wondering, how does a construction materials company offer excellent long-term returns? There doesn’t seem to be a great amount of innovation or technology involved. The whole idea seems (very) boring...

But here is what most people are missing…

Boring is actually a good thing. Boring companies, in boring industries, with boring sounding names are usually undercovered by analysts. They are more likely to be undervalued. After all, investors and analysts are only human. Why invest in Local Cement Co when you can throw money at the next Super AI Chip Accelerator Inc. Peter Lynch made a great career out of picking boring companies before their value was recognized by the market. Lets get some background on the cement industry to get up-to-speed. Later on, I will discuss my top pick among construction material stocks in the U.S.

Cement companies have a BIG hidden advantage.

Construction materials companies tend to form local monopolies. Here is a relevant excerpt from Peter Lynch’s book “One Up on Wall Street:

“I’d much rather own a local rock pit than own Twentieth Century-Fox, because a movie company competes with other movie companies, and the rock pit has a niche…What makes a rock pit valuable is that nobody else can compete with it. The nearest rival owner from two towns over isn’t going to haul his rocks into your territory because the trucking bills would eat up all his profit.

Advantages of the cement industry:

Cement and aggregates have a low value-to-weight ratio.

This mean you can buy a lot of (heavy) cement for a low price. The materials become expensive to transports for long distances. The local producer close to the customer always has an advantage. Truck shipments of cement are generally limited to a 150-mile radius (241 km) from each plant, while rail shipping is usually limited to 300 miles (482 km) by rail, and further by barge.

Environmental and zoning regulations make it difficult for new entrants.

Think about it, how many big cement plants do you want operating around your town? Probably not many. This means that each region usually has one dominant player, leading to a local monopoly.

Stricter environmental laws mean that it is hard to set up new plants. This makes existing plants more valuable. Bigger players can still expand through acquisitions.

Less susceptible to technological disruption.

Cement is a necessary component of concrete. It is unlikely that a new strong and durable material will be invented that can compare with the cost-effectiveness of concrete (a mixture of rocks, sand, water and limestone). Cement companies do not need a constant stream of new innovative products.

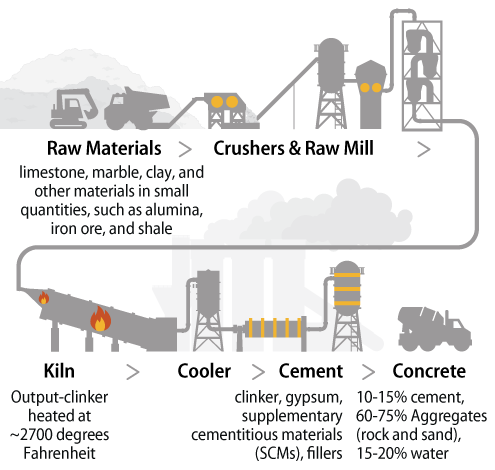

A quick overview of terms

(in case you are getting confused):

Cement: A fine powder made from limestone and other minerals which is used as a binding agent when making concrete. Cement hardens when it comes into contact with water.

Concrete is a mix between cement (the binder), aggregates (sand and gravel which give strength), and water. Concrete is used for construction due to its strength and high durability.

Asphalt is made from aggregates (sand, gravel) and bitumen. Asphalt roads are cheaper to produce and easier to repair, but shorter lasting and have less strength compared to concrete roads. Many highways are made of a base layer of concrete and a surface layer of asphalt. Asphalt is not used for buildings or bridges as it lacks strength.

Here is a diagram of the cement manufacturing process for those interested:

How my (odd) interest with cement started.

As an aside, I will explain how I got interested in this sector in the first place. Each time I visited the United States, one of the first things I noticed is the massive amount of concrete and asphalt everywhere. I noticed this as soon as I stepped outside the airport. The highway system is extensive with huge overpass bridges. Compared to other countries, even smaller city roads appear to have 2-3 extra lanes. One is surrounded by endless parking lots and parking complexes. The infrastructure is very car-centric and people drive bigger cars (pickup trucks) due to the abundance of road space.

While observing this, it struck me that it would cost a fortune to not only build this infrastructure, but to maintain it over time. A constant stream of construction would be needed. The U.S Infrastructure Investment and Jobs Act in 2021 set aside over 1 trillion dollars of government spending for various infrastructure improvements (only 25-50% of this has been spent so far). Public infrastructure accounts for about 50% of total cement demand. This led to my investigation into construction material stocks.

What do big investors think of cement?

You won’t find many reports or analyst recommendations for construction material companies. This is part of the charm. If you check the holdings of some superinvestor funds, you will find a few concrete bets (pun intended):

Seth Klarmann: Positions in CRH (7%) and EXP (4%).

Howard Marks: Position in CX (1.4%).

Now for my top pick (drum roll…) - Eagle Materials (EXP):

Eagle Materials (EXP) manufactures and distributes construction materials in the United States including Portland cement and gypsum wallboard (dry wall). EXP is vertically integrated. They own the mines (resources), production plants and distribution terminals. They primarily operate in the central U.S heartland states.

In their 2024 annual report, EXP management highlighted several advantages:

Location: Plants are near both raw material reserves and customers in high growth markets. In many cases they are able to supply customers from multiple plant locations in their network.

Size: Production plants across several states provide geographic diversification.

Low cost producer: Consistent focus on efficiency improvement with modern production lines.

High Reserves: Own 25+ years of raw material reserves.

Insulated from imports: A minority of total cement (10-25% depending on prices) is imported into the U.S. EXP’s plants are insulated from this as they produce in the U.S heartland, away from coasts and borders.

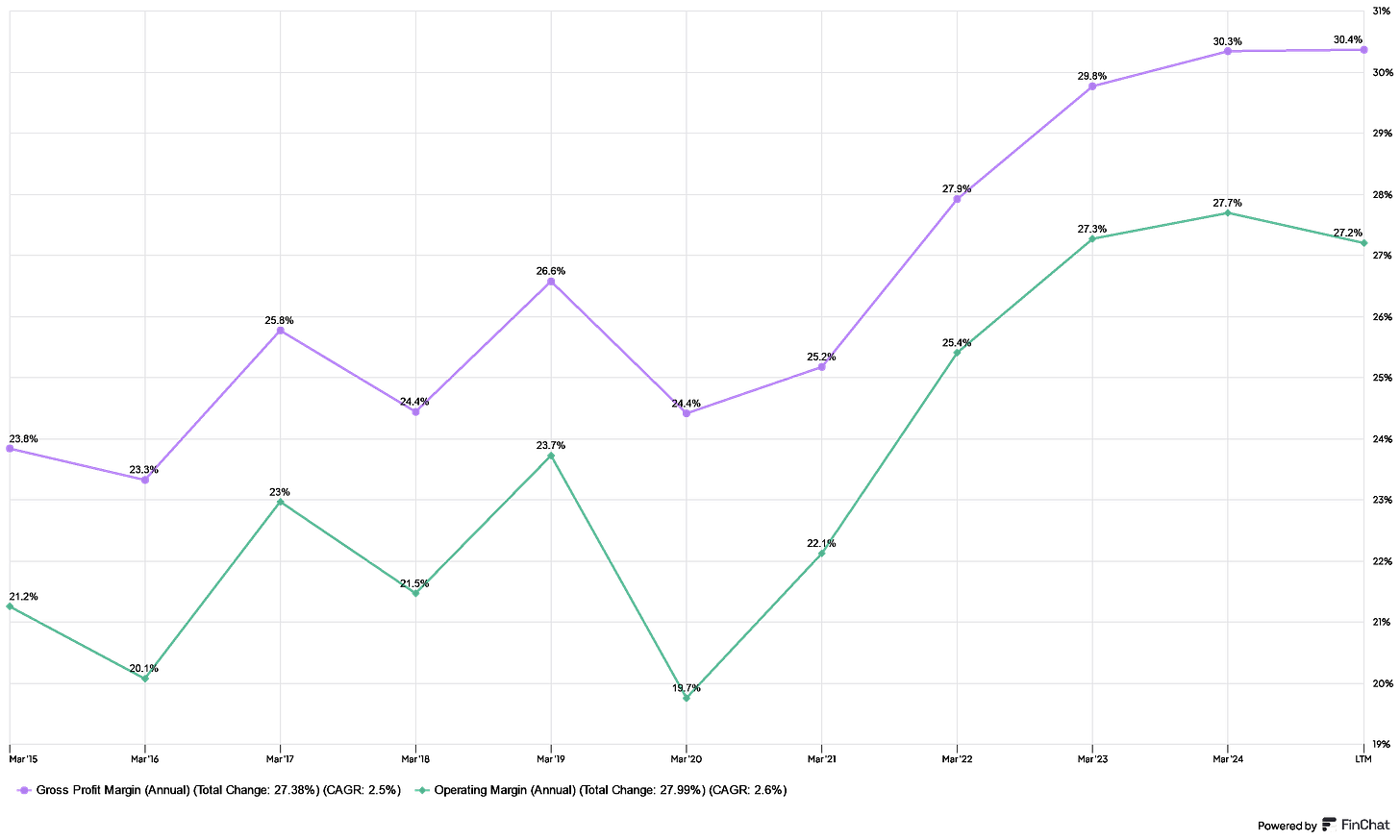

Despite being in a cyclical industry, EXP is increasing margins over the long-term:

Let’s compare EXP to the competition:

Making cement is capital intensive. Companies that operate efficient local monopolies and have economies of scale should have the highest return on invested capital (ROIC). I tried to account for fluctuations in earnings by comparing ROIC 3 year CAGR, given cement is a cyclical industry.

Eagle Materials (EXP) has the highest mid-term ROIC (3 year CAGR) out of the group, about double the average. It is likely that EXP has intrinsic advantages over the competition. Its revenue growth over 3 years is slightly above the average at 11.7%. Furthermore, its valuation is below average with an EV/EBITA of 10.4. It is being priced as a no-growth stock, despite significant long-term revenue growth.

Excellent management strategy:

Reading the early 2024 annual report gives you a sense that management is focused and long-term oriented.

Some quotes:

“We seek to double our earnings from “peak-to-peak” across cycles through organic investments and prudent acquisitions.”

They recognize that they are in a cyclic industry, but want they want the peaks to be up-trending.

“Every growth opportunity we consider must meet high strategic and financial-return standards while reinforcing Eagle Materials’ low-cost producer position.”

Efficient allocation of capital is a priority.

“Over the last five years, we have invested almost $1.4 billion back into our business ($912.9 million in acquisitions, $485.9 million in organic capital expenditures).”

The company has a high reinvestment rate in order to expand their business. It has the qualities of a long-term compounder.

“This past fiscal year (fiscal 2024) alone we returned $378 million to shareholders through share repurchases and dividends. Over the last five years our share buyback program has reduced the overall stock float by approximately 30%.”

This sounds like a very share-holder friendly company. With share repurchases, your ownership of the business will increase over time.

Capex going foward:

On August 9, 2024, finalized the acquisition of an aggregates operation in Battletown, Kentucky.

On January 7, 2025, purchased Bullskin Stone & Lime, LLC, a pure-play aggregates business located in Western Pennsylvania (the Pennsylvania Acquisition).

For fiscal 2025, capex expected around 235M. Expansion of its Mountain Cement facility, increasing capacity by 50% to serve the fast-growing Denver and Salt Lake City markets. Expected completion in late fiscal 2027.

Risks:

Currently, cement revenues and profits are slightly down in 2025 due to lower sales volume this year. This may lead to a good entry point.

EXP is affected by demand in construction which is cyclic. Private construction is sensitive to interest rates.

Increased cost of fuel (coal, petroleum coke, natural gas) can decrease margins. Fuel is usually abundant in the U.S heartland where they operate.

Sensitive to changes in environmental regulations

Thanks for reading!

- Stock Doctor

Disclosure: I have a small long-term position in EXP. I will consider adding to this position in the future.

Disclaimer: This article is for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.