Land is the real inflation hedge, exploring farmland stocks and other options

"Buy land, they’re not making it anymore."

This decade might be marked by recurrent and sticky inflation. The ability for many countries to raise interest rates is limited by large debt burdens, while tariffs and partial de-globalization may stimulate inflation.

Investors may wish to hedge against inflation, but what is the best way to do this? Would we look to equities, gold, Bitcoin…DOGE coin? As the value of cash erodes, one might ask if gold is the answer. We can point to its thousand year record of maintaining purchasing power. Even central banks scramble to hoard it their vaults. Although gold and crypto currencies can be used as a store of value or a unit-of-exchange, they have one important problem…They are not productive assets.

Warren Buffet’s comment on gold summarizes this best:

"I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today's market prices about $7 trillion – that's probably about a third of the value of all the stocks in the United States…For $7 trillion…you could have all the farmland in the United States, you could have about seven Exxon Mobils (NYSE:XOM) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I'll take the farmland and the Exxon Mobils."

It is notable that Warren highlighted farmland as a productive asset that contrasts with gold. Land is a finite asset. Productive arable land is even more limited due variability in climate zones and soil quality.

Performance and Safety:

A study by Painter (2011) highlights that investors would have improved performance with Canadian farmland REITS as opposed to gold over the long-term. Farmland had a low correlation with other asset returns.

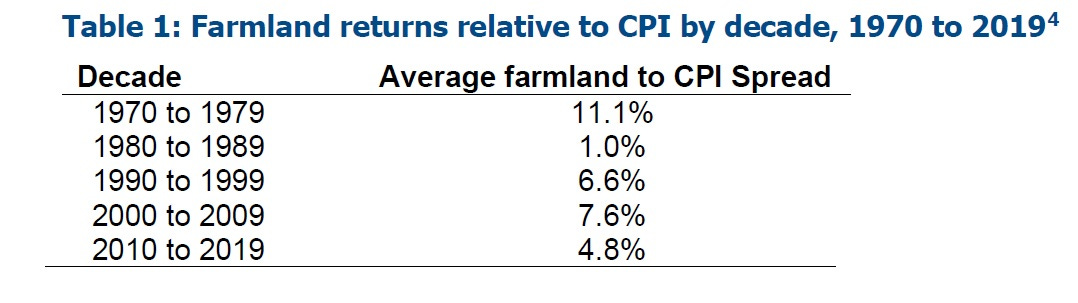

This trend is also seen in U.S farmland returns across 32 agricultural states (NCREIF Farmland Index). The chart below shows that total farmland returns consistently rise above the consumer price index (CPI), particularly in periods with high inflation such as the 1970s.

The paper also demonstrates that the index of U.S farmland outperformed U.S equities while having lower drawdowns as well as low correlation with other assets. Farmland had higher correlation with CPI (0.65), which is what we are aiming for with an inflation hedge position.

How much does farmland cost?

Let us focus specifically on cropland, which excludes land used for pastures. According to the U.S Department of Agriculture Land Value Summary, the average acre of U.S cropland costs $5,570.

Prices can be affected by a number of factors such as location, crop type, crop yields and irrigation. Areas that grow higher value products like wine and pistachios are more expensive (i.e California). Being close to large urban centers also increases land value (California, Florida, New Jersey). The U.S “Corn Belt” typically includes: Iowa, Illinois, Indiana, Ohio, Nebraska and Kansas. You can see that these states typically command a higher premium in the $6500-9800 range. Soybeans are grown along a similar distribution.

Ok, you convinced me that farmland is interesting. What are investment options? What are the valuations?

The first option is to buy farmland directly. This works well if you are a farmer… or if you are Bill Gates (who now owns 250,000 of U.S farmland).

An easier alternative is to own companies that operate farmland. The benefit of owning farmland indirectly is that you don’t need to operate the farms. Furthermore, large farm portfolios are usually diversified across geographical areas which reduces the risk of natural disasters or poor local yields.

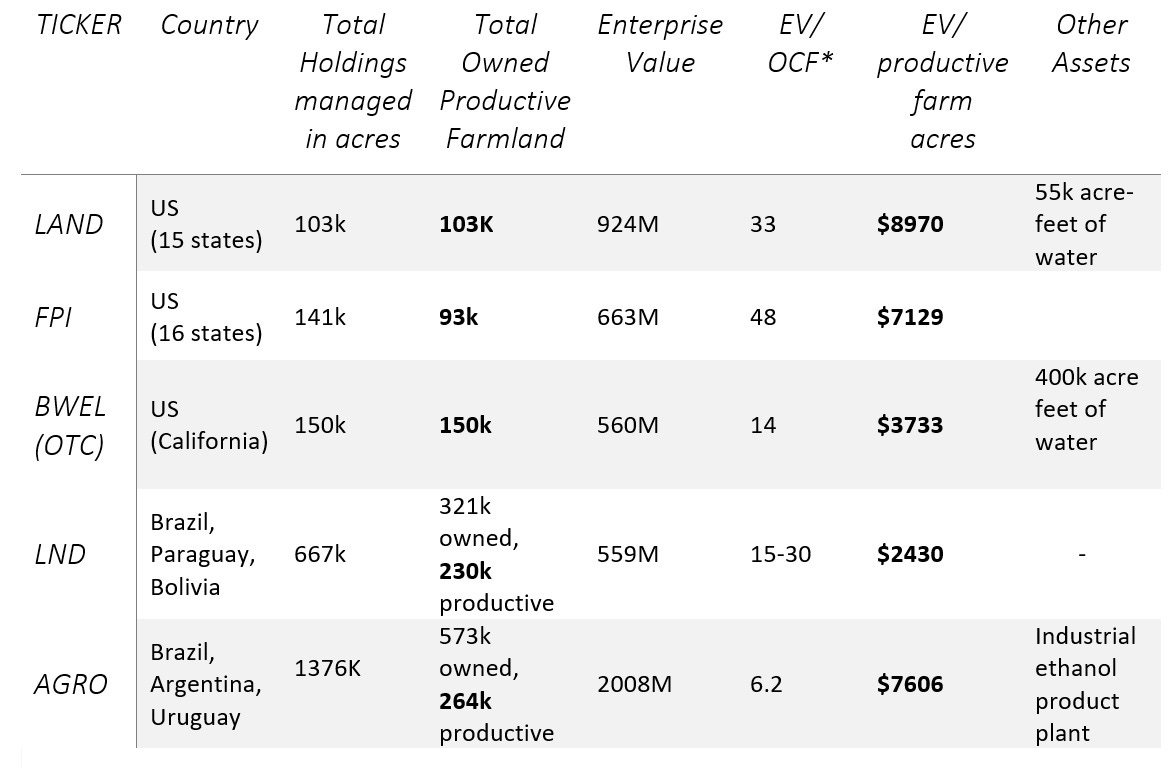

In the table below, I compare some public companies with large farmland holdings:

I separated total land holdings managed by a company (leased + owned) with the land they own outright. This gives a better picture of the true value of the balance sheet. LND and AGRO own a large amount of undeveloped arable land along with their productive farming assets. In Brazil, a small portion of their owned but non-productive land is reserved for ecological reasons as per government regulations.

A quick scan of the table shows that U.S farmland REITS are fairly expensive on an operating cash flow basis (EV/OCF) and when looking at their valuation per acre (EV/productive farmland acre). LND (BrasilAgro) operates primarily in Brazil (an agricultural powerhouse) and appears to offer more value at this time. Its price per productive acre that is 3x cheaper than for the U.S farmland REITs.

LND holdings consist primarily of soybean, corn and sugarcane farms. Its current productive farmland is valued at $2430/acre, which is less than the average acre in the U.S corn (and soybean) belt ($6500-$9000 range). It is true that U.S corn fields typically have double the crop yield of their Brazilian counterparts. However, soybean yields per acre are comparable between the two countries as seen in the chart below:

Brazilian stock prices have fallen due to concerns about the Brazilian fiscal deficit and the low Brazilian Reale. This may be temporary set-back. By developing more of its land holdings into productive cropland, LND can further unlock its asset value. The downside of LND is its business is inherently cyclical and tied to commodity prices. Cash from operations are down in 2024 from a peak in 2022-2023, the cyclic peak in soybean/corn prices. Dividend yield is almost 8%, but without asset sales they will likely have to cut this due to lower cash from operations. For this reason, I am holding off on purchasing this company for now despite their undervalued assets.

For investors that prefer U.S land holdings, JG Boswell (BWEL) is an interesting yet and lightly traded company on OTC markets. This unknown company is actually one of California’s largest land owners. I will do a write-up on BWEL in a future article as its land holdings appear to trade at a significant discount to typical California farmland.

Alternative Land Holding Ideas:

If farmland is not your style, there are other types of land-holding stocks that can be considered:

Timberland REITS - Rayonier, PotlatchDeltic and Weyerhaeuser.

TRC - Own 270k of land near Los Angeles. 6k acres used for farming, the rest is used for hunting, horseback riding and filming. A portion (about 10%) may be used for future real estate developments with regulator approval. EV/Acre priced at: 1.8k per total acre,18k per potential development acre.

JOE - Own 110k in Northern Florida that could be used for housing developments. Priced at roughly $30k per acre.

LB - Own 227k acres in the Permian basin with use cases for oil drilling and setting up data centers. They also own subsurface water. Current price values them at about $8237 per acre (dry desert land).

TPL - Interest in 873k acres in the Permian basin used for oil fracking (but only 23k net royalty mineral acres). Dry desert land. Priced at an outrageous $32 billion market cap with a PE of 72…

Farmland Risks:

The farming industry can be a complex interplay of cyclic crop prices along with fluctuating fertilizer and seed prices. There are obviously weather-related risks where unexpected droughts or flooding can damage yields. Companies often buy insurance for weather-related events and also engage in some form of commodity price and FX hedging.

Investors can increase their margin of safety in this space by buying profitable companies for large discounts to the underlying value of their land. During downturns, land sales are always an option for a company with a massive inflation-resistant portfolio.

Conclusions:

Farmland companies can function as an effective inflationary hedge within a portfolio and outperform during inflationary economic environments.

- Stock Doctor

Disclosure: I do not own any of the companies in this article. I may consider purchasing some of these companies in the future.

Disclaimer: This article is for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.

very informative article!