The Tariff Test: Are you a value investor or not?

“A mariner does not become skilled by always sailing on a calm sea.”

“A mariner does not become skilled by always sailing on a calm sea.”

- Heber J. Grant

You know what would be great? If the market could consistently return 20% annually, just as it did in both 2023 and 2024. We could watch our accounts grow with the consistency of a Swiss watch, everyday ticking upwards without any unexpected delays. All of us would be compounding like we are Warren Buffett (19% CAGR career), while just mindlessly holding the SP500 on our upward journey to infinity.

Ok, back to reality.

Since the imposition of reciprocal tariffs last week, the market has fallen sharply and is approaching bear market territory. You now have people forecasting a deep global recession and other doom and gloom. Most portfolios are being painted a deep shade of red while the broker’s SELL button has never enjoyed so much attention. The VIX Volatility Index reaches levels not seen since March 2020 (early COVID pandemic).

There are too many variables involved in macro forecasting for it to be a useful endeavor for investors. Sometimes we might be able to gauge a country’s trajectory or a new global trend, but there is usually an element of speculation.

Right now we can imagine many different short term scenarios.

For example, tariff’s can continue to escalate in a tit-for-tat war where neither side concedes, resulting in a recession.

Alternatively, tariff’s could be successfully negotiated away with concessions and everyone can claim to be a winner.

Tariff’s could also decrease but continue to be held in place; re-shaping global supply chains and likely resulting in sticky inflation.

Each of these scenarios then branches off into dozens of sub-scenarios in a widening chain of uncertainty. Policies can be reversed at any time while new policies can emerge.

We don’t have to predict what will happen next on the world stage.

Value investing is not about macro forecasts and geopolitics. We must be aware of the macro-environment and downside possibilities, but ultimately we are buying individual businesses and not the entire market. Furthermore, we must be focused on long-term performance and not a drop in forecasts over the next few quarters.

“An old saying is that in a bull market, your time horizons grow longer and longer. In a bear market, they grow shorter and shorter.” - Tom Gayner

Investors cannot know the future of macro-economics and geopolitics.

What we can know is today’s price and valuation.

The questions you should be asking is, do I think this stock is undervalued relative to its long-term prospects? Is a stock being priced for zero growth, when we know they are likely to grow over the next decade? Is there a large margin of safety?

If you like the current valuation, then you can consider buying.

This is the real decision you have to make. We can try to look for businesses that are mostly unaffected by tariffs. Alternatively, we can look for stocks that are affected by tariffs, but they are so cheap that they are still worth buying. By bringing down prices across the board, tariffs are paradoxically increasing our opportunities on a long-term basis.

As Howard Marks says:

“There’s no asset so good that it can’t become overpriced and thus dangerous, and there are few assets so bad that they can’t get cheap enough to be a bargain.”

It was difficult to find bargains in 2024. Nowadays, there are an increasing number of opportunities available. Quality companies that seemed out of reach with their lofty valuations are now back on the menu. It is easy to say you will buy the dip, but much harder to do in practice when you are surrounded by pessimism. There are always reasons to not invest during a downturn. I will continue to slowly buy attractive positions over time. The market may fall another 30%, but projecting how far it will fall is speculation and not value investing.

“People do not consciously choose to invest according to their emotions — they simply cannot help it.”

- Seth Klarman

Could we have anticipated this drop?

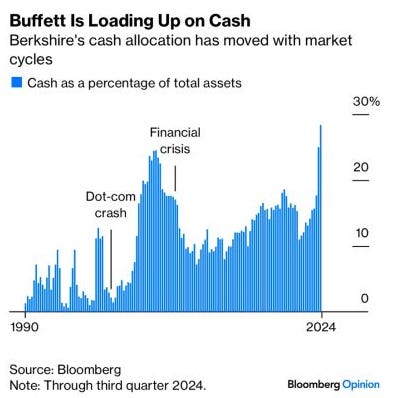

The Oracle of Omaha certainly seemed to have seen this coming. Like a fortune teller, he built up Berkshire’s cash pile over the course of 2024 even as the SP500 continued to post excellent returns.

Did Buffet predict the exact sequence of events that would unfold, back in 2024? Did he know the exact trade policies that would spark a global sell-off and the market’s exact reaction? Unlikely. What he did know in 2024 is that the market was historically over-valued. 10 year returns trend downwards when we overpay for equities. This correlation is almost perfectly linear.

Buffet did not know when a crash would happen or how deep it would be, but he knew he wanted to increase his cash position and decrease his risk. He did not exit the market completely, but he calibrated his portfolio composition to account for the changing probability of outperformance.

“If the stock market has a period of outperformance of its long-term return, it is inevitably followed by some period of underperformance. But people being optimistic and greedy by nature take the recent short-term outperformance of stocks as a sign of good things to come, rather than a warning of bad things to come.” - Seth Klarman

In some ways we could have seen this crash coming, regardless of the trigger. Buffet has once again taught us a valuable lesson. Cash reserves give investors the option of future purchases.

Cash reserves are a bet on future opportunities.

By not maintaining cash reserves, many of us were essentially saying that the present has far greater opportunities then we are likely to find in the future. You always wish you had more cash in a crash. If we see this fall in the market as a punishment rather than an opportunity, it is likely due to our own lack of discipline.

I will leave you with one final quote to contemplate.

“In bear markets, stocks return to their rightful owners.”

- J.P Morgan

- Stock Doctor

Disclaimer: This article is intended for informational and educational purposes and does not constitute individualized financial advise.