WISE: Competing for a trillion dollar market (PART 1)

Wise Plc could become a fintech giant by powering global currency exchange.

In PART 1 of my analysis we will discuss the following:

Contents:

Introduction

Why cross-border transfers are ready for disruption.

How big is the market?

Growth

Does Wise have a competitive advantage and a moat?

Unique culture maintains the moat.

Future potential and vision…the road to a trillion

Risks to the thesis

In a separate article (PART 2), I will examine the competitive landscape with new fintechs and neobanks.

Introducing…

Wise Plc (LSE: WISE) is a leading digital provider of cross-border money transfers and currency exchange. They allow both individuals and businesses to hold over 40 currencies in one account, move money between countries and spend money abroad. Wise obtains revenue from cross-border transfers (63%), card services (26%) and income from interest on customer balances (11%).

Their customer base has grown to over 12 million customers globally for their Wise Account and Wise Business offerings. Wise Platform is their third and newest business segment, where they have expanded into providing their cross-border infrastructure as a service to banks/enterprises who don’t have the same global connections.

The Wise Platform is what I am most excited about. It is a “wise” pivot to bypass the competition.

Before we discuss the platform segment, let’s quickly go over how Wise works.

Why cross-border transfers are ready for disruption.

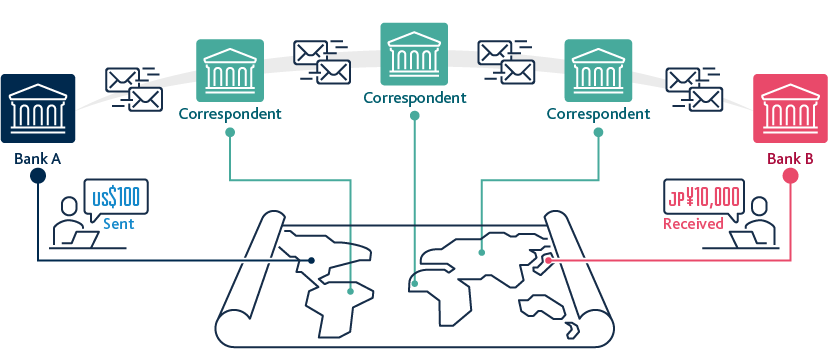

Typically, to transfer money overseas requires using the SWIFT network. Banks don’t usually have direct connections with foreign recipient banks, they have to use a system of “correspondent banks.” These correspondents act a intermediaries to perform the cross-border transaction through a series of steps on the SWIFT network.

There are often multiple correspondent banks involved in a single transaction. At every step of the way, the transaction has to be verified. Each middleman involved charges a fee and takes their own cut. In the end, you have an expensive cross border transfer that can takes 3-10 days to fully settle.

Wise has come up with a system that mostly bypasses this process, they don’t actually move the money. Instead the process looks like this:

Wise receives the money you send in Currency A to its account in Country A.

Wise calculates the conversion of currency A to currency B at the exact mid-market rate, and adds a small fee (take-rate).

Wise transfers Currency B from its local account in Country B to the recipient.

These local transactions help bypass the long process of correspondent banking, thereby increasing speed and decreasing costs. Wise will sometimes need to re-balance its global currency holdings if flows are usually moving in one direction between countries, but in general it keeps transfers local.

How big is the market? How long does it take to count to a trillion?

(Hint: 31,709 years)

£27 trillion ($34B USD) is moved across borders annually including:

£2 trillion moved by individuals.

£12 trillion by small businesses.

£13 trillion by large enterprises.

The vast majority of this money is moved by legacy banks. These are large slow giants, just sitting around and waiting to be disrupted. Banks have profited heavily from cross-border transactions for years and have little incentive to re-invent the wheel and lower their margins.

A new class of fintechs is emerging that promises to improve cross-border money transfers. The perfect provider would have the following characteristics:

Cheap: Minimal cost for currency conversion. Provide conversion as close to the mid-market rate as possible.

Fast: Transfer money as quickly as possible so that customers don’t have to wait or wonder where their money is.

Global: Having an expansive network covering the globe and all major currencies.

Volume: Can conduct large and frequent transfers without limitations.

Reliable/Trustworthy: Financial institutions need to be trusted by both customers and regulators. It is critical that they prevent money laundering, fraud and cyber-attacks. Furthermore, a transfer service needs to accurately predict and manage their liquidity at all times (ensure they have enough of each local currency to complete the transaction).

Easy and streamlined process: Quickly and easily onboard new customers and offer a seamless transition to the new service. Provide good customer support.

Wise appears to be addressing each of these points:

Cheap: They have lowered their take rate recently in Q3 FY 2025 to 0.56%.

Fast: 63% of transfers happen instantly (<20 seconds), compared to the days it takes for traditional banks to send money via SWIFT.

Global: Network covers 160 countries, 40 currencies and 65 licenses.

Volume: Wise currently processes ~$14 billion per month, which is increasing over time.

Reliable/Trustworthy: Large number of financial crime staff and AI algorithms to detect financial crime. Wise also offers transparency in its fee structure, even offering a tool to compare conversion rates across competitors.

Easy and streamlined process: Offer 24/7 customer support and quick on-boarding to open an account.

Growth:

As of Jan 2025, Wise is growing customers by 20% y/y, cross-border volume by 24% y/y, and customer balances by 26% y/y. Although these are usually solid numbers, the growth is lower than the 4 year CAGR for these measures (29%, 30% and 59% respectively). This may reflect a temporary slow down in growth, the impact of increased competition or the difficulties of compounding with increased size. They also had to pause on-boarding of new customers in certain countries in 2024 due to technical issues.

So how can growth re-accelerate in the future?

By leveraging their network and moving greater volume for large enterprises.

Sine banks can’t offer the same competitive cross border transfers that Wise can, Wise is charging them to use its network through Wise Platform.

This system is great for customers as they are offered better cross-border services in their own bank. It is good for Wise as it doesn’t have to snatch customers away from their sticky legacy banks which can be difficult. The banks benefit by remaining competitive in their offerings without having to invest in their own global infrastructure. This is a net Win-Win-Win for everyone.

One issue that Wise has encountered is that it can take a long time for banks to integrate new platform services into their old infrastructure. To ease this process, Wise began collaborating with SWIFT. This allow banks to send money to Wise via a standard SWIFT pathway, then Wise can complete the rest of the transaction steps on its own network to avoid additional middlemen. This collaboration eases the on-boarding process for large enterprises.

Wise has achieved notable integrations with fast growing neobanks like NU (Latin America), Monzo (U.K) and N26 (Germany).

More recently, they announced that Morgan Stanley (market cap: $193B) is now using Wise for international settlements for corporate customers. Wise believes that their platform segment will account for the majority of volume over time.

Is the moat growing? They are digging it right now…

Direct integration with a country’s financial system is a long process that requires years of regulatory processes and obtaining government trust. Wise works to be vertically integrated in each country over time by slowly removing middlemen in the network.

Recent network enhancements include obtaining:

AD II license in India: This removes a $5k cap they had on Indian transfers, increasing the cap to $250,000 per transaction. India is a massive market.

Type 1 Japanese license: Transaction limit increased to ¥150 million yen (~ $1 million dollars).

Low costs and excellent customer service creates happy customers who recommend the service to others. Expanding through evangelical customers allows the company to save on traditional marketing costs. 70% of new customers are referred by a friend to the service, which is an excellent record.

Unique culture maintains the moat:

“Money without borders.”

While corporate culture is often a cliche, in the case of Wise I believe their culture adds tremendous value. I like the fact that they have a fairly singular mission and clear future goal; processing trillions of dollars of cross-border transactions in the most customer-friendly manner possible. This focus contrasts with some other fintechs such as Revolut, which are aggressively branching off into so many different services. According to interviews, both Wise and competitor Revolut structure their companies into fairly autonomous small teams which tackle specific goals. This type of mini-business structure may encourage independent thinking and speed.

With its clear goal in mind, Wise firmly embraces the “scale economies shared” model. They are constantly trying to decrease costs and return value to the customer to drive growth. In fiscal 2024, they advertised saving customers £1.8 billion after processing £118bn billion in cross-border transactions.

Wise is constantly becoming more competitive by investing in cheaper, faster and more wide-spread services. Although this strategy can lower margins in the short term, it provides greater long-term returns. In fact, the company is actively targeting a lower net profit margin. Their net profit margin is 27% and they are trying to push this down to 13-16% in the near future. Their goal is also to returns 80% of their interest income back to customers. This is a way of further rewarding their users and encouraging them to hold large account balances.

Wise refers to its investors as “owners” to encouraging long-term thinking. They emphasize radical transparency with fee structure and customer education. Wise offers a cost-comparison tool on their website that openly compares currency exchange rates across all major competitors.

Future potential and vision…the road to a trillion

Investor Nick Sleep believed in looking at a companies destination rather than focusing on short term changes. Let’s examine Wise’s destination.

The CEO/Co-founder of Wise outlined his future vision for the company in a 2024 report. The company is open about its goal of processing trillions:

“It’s reasonable to expect that in ten years, someone can transfer $10,000 across currencies for $10, compared to the current banks’ price of $200-$400. We intend Wise to be the one operating these transactions at that price point, with our cost base brought down to $5 or less. It will be profitable and very valuable, when the cross-border volume on our platform is in the trillions. We won’t be able to achieve this level of efficiency overnight. Nor will the customer response be immediate as we iterate prices, but we believe it’s inevitable that the lowest priced provider with the best experience will win the scale needed over time to become one of the most valuable providers of financial services in the world.

I also believe this market is prone to consolidation over time. Currently, many small fintechs can survive as they are taking market share from legacy banks which is low hanging fruit. Eventually, companies with larger and more efficient networks will be able to out-compete the smaller players. The winners will benefit from both network effects and economies of scale. This inevitable consolidation may be similar to credit card networks, where global transaction volume is split between Visa (39%), UnionPay (34%) and Mastercard (24%).

The current global market is £27 trillion ($34T) and we can assume its growth will at least keep up with inflation over time. If Wise were to attain a sizeable 12% share of the market in 10 years, it would mean processing over $4 trillion annually. I think they have a reasonable chance of achieving this due to their competitive advantages. If take rates are distilled down to 0.2% due to increased efficiencies, this results in $8 billion in cross-border revenue. 63% of their revenue today is from cross-border activities while the rest comes from related card services and interest. If we assume this distribution can continue in the future we get a total annual revenue of $12.6B.

Currently, the net profit margin is 27%. In the short term Wise wants to lower this to 13-15% to give back to customers, but it will rise again with increased efficiencies in the long run. If we use the current margin of 27%, Wise would earn $3.4B annually. If we assume a PE ratio of 20 for this quality business we get a market cap of $68B. The current market cap of Wise is about $12B USD (£9.7B), resulting in…

18% compounded annual return over 10 years (on top of inflation).

Admittedly, this is an optimistic projection as a global market share of 12% is not guaranteed. There can be new disruption in the market. On the other hand, the take rate used in this calculation is exceptionally low so you can play around with the numbers yourself. Overall, I think the odds of achieving their goal are reasonable based on their competitive advantage and culture.

I got tired of converting between £ pounds and $ dollars while writing this, I should probably use the Wise app...

Risks to the thesis:

Regulators: Wise may have difficulties getting regulatory approvals for new expansions, or may get fined for lack of compliance. For example, the U.S financial consumer protection bureau has now ordered Wise to pay a $2.5 million fine (Jan 2025) over advertising inaccurate fees back in 2022.

Trust: They may lose customers if there is a cybersecurity breach.

Capacity: Wise has paused issuing multi-currency cards in the U.S this year due to “operational issues” and is working to resolve this. Wise stopped taking new customers in India for several months before recently resuming on-boarding and increasing the transfer limit. These types of constraints could cost them customers.

Competition: In a separate article (PART 2), I will examine the competitive landscape with new fintechs and neobanks.

Total disruption: Alternatives to their system could emerge such as transfers via digital currencies, blockchain networks and other financial voodoo. I don’t put a lot of weight on this.

Thanks for reading. Stay tuned for the second part of my Wise analysis.

- Stock Doctor

Disclosure: I plan on buying WISE over the next few months.

Disclaimer: This article is intended for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.

Been reading more and more about Wise the past few weeks. A compelling business for sure

Why do u think that stable coins pose a low risk to Wise? I think that it is much higher than u think.