WISE: Competing for a trillion dollar market (PART 2) - New rivals

Examining the competitive landscape from fintechs to stablecoins.

In PART 1 we discussed the fintech Wise (LSE: WISE) and its competitive advantages in cross-border money transfer.

In PART 2, we will now look at the competitive landscape in this massive market. Before we survey the new fintechs, let us mention the legacy banks that are being disrupted.

The global average cost of sending $200 USD in 2024 was 6.62% among all providers. Banks were the most expensive service provider, with an average cost of 13.64%. On the other end of the spectrum, an index of digital-only providers averaged 3.87% (Wise, Remitly, WorldRemit, InstaReM and Xoom).

There has been a slow downward trend in fees associated with the digital segment. It is quickly apparent that banks are not in the same league as digital-only providers. Digital-only providers offer the same service for a 3x lower cost and faster speeds.

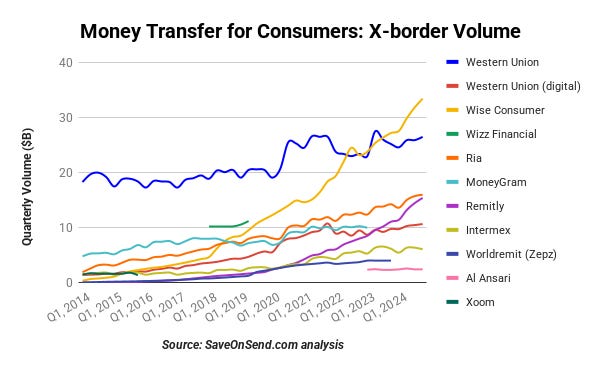

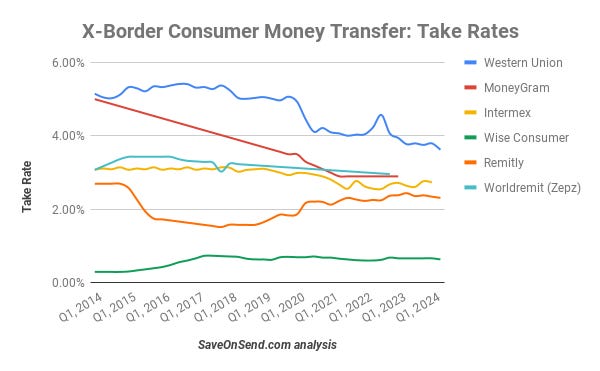

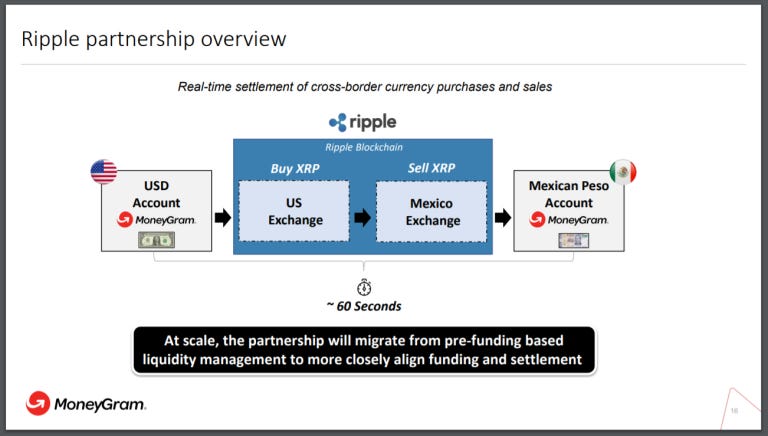

The next layer of competitors includes an older class of transfer providers like Western Union, MoneyGram, and Ria. Western Union has the longest operational history and was originally founded in 1851 as a telegram company. They primarily offer cross-border transfers where recipients can pick up physical cash at brick-and-mortar locations. Older providers like Western Union have enjoyed the benefits of high fees and have been slower to adapt to digital trends. This is reflected in their loss of market share to fintechs.

Wise finally surpassed Western Union’s consumer volume in 2024. Since Western Union has many physical branches, its costs are inherently higher which results in higher fees for customers.

Although Western Union has dropped take rates over the past 10 years, they are still not competitive with Wise which has an average rate of 0.59% in 2025. This varies based on geography, for example a transfer of £2000 into euros is only charged 0.1%. A transfer into a less popular currency would cost significantly more.

The New Rivals:

A series of fintechs has emerged over the past decade to challenge Wise. This will be a survey of some key players, but it is not a complete list. Depending on the currency being converted and the amount that is being transferred, different providers may be cheaper.

Remitly:

Remitly (NASDAQ: RELAY) is a public company with a $4B market cap in the same niche as Wise. They serve 7.8 million customers and operate in 170 countries, with a leadership position in U.S corridors. Despite revenues growing at 33% (previously in the 40%+ range), they have yet to become profitable with a net burn rate of 5%. The company anticipates positive net income for 2025, but this is yet to materialize. They spend 24% of revenue on marketing while while Wise spends around 3%. Therefore, Remitly could easily drop its marketing costs to facilitate profitability but this may compromise its growth rate. Wise has more room to grow from a marketing perspective while Remitly is already strained. Remitly’s average take rate in 2023 was 2.39% (compared to 0.59% offered by Wise).

Revolut:

This private neobank is a big competitor with Wise, users are able to hold and exchange 30 currencies and pay in over 150 currencies with Revolut’s debit card. Revolut users pay for a subscription service so the actual costs of currency conversion are more opaque. While having a slightly higher income than Wise, their customer base is far higher (45 million in June 2024 compared to 12 million with Wise). Between 2022 and 2023, revenue grew from £0.7B to £1.3B, indicating faster growth compared to Wise. Net profit margins were solid that year at 19%, but they are somewhat inconsistent year-to-year. Revolut spends $300m (£241m) on marketing to grow their service.

Despite these impressive numbers, I still prefer investing in Wise for a number of reasons. Let’s start with valuation. Revolut is targeting an IPO with a $40-60B USD price tag compared to Wise’s market cap of $12B. Its 2023 year profits were 20% higher than Wise’s 2024 profits, but it may have a price tag that is 3-5x higher. Revolut is being priced for a very high growth scenario.

Secondly, Revolut has often subsidized it’s currency conversion with profits from other business segments. It is unclear how profitable FX is for them currently. Revolut used to charge customers an extra 1% for weekend transfers, which suggests a large part of their transactions were going through the regular SWIFT network (banks are close on weekends). If they had their own rails, weekend fees would not be an needed. In addition, they outsource some of their FX services to other providers such CurrencyCloud in the past (2021) and Thunes more recently.

Thirdly, Revolut and Wise differ in their overall goals which is something we must consider when making comparisons. Revolut is a digital neobank that happens to have a favorable FX exchange service. Revolut has a banking license while Wise does not wish to be a bank or provide loans. Revolut’s diverse offering encompasses loans, credit cards, insurance and crypto trading. They are planning to release mortgage products (in select countries) and even non-financial services like phone data packages (e-sims).

You might be thinking that this long list of services is an advantage for Revolut. They have higher revenue growth and these services could create a sticky ecosystem. However, my perspective is that Revolut is trying to compete in too many avenues at once and will face a high level of competition in each of these services. I am not sure how sustainable this growth will be.

In contrast, Wise remains focused on currency conversion and building the widest moat in this specific segment. By building the best FX network, Wise will be able to offer its network services to other banks through Wise Platform. Instead of competing with banks (which Revolut is doing), Wise is making them customers and joining forces

As an brief aside, I think we can find an analogous situation in the semiconductor industry. TSMC is focused specifically on manufacturing chips and not designing them. Samsung is more vertically integrated with chip design, chip manufacturing and building their own phones. Customers such as Apple prefer to make chips with TSMC, rather than using Samsung which a direct smartphone competitor. Similarly, NVIDIA (a chip designer) will preferably manufacture with TSMC rather than use Samsung who wants to design their own chips and compete with them. Don’t compete with your customers. In some ways, Samsung’s vertical integration (design chips, manufacture chips, make phones) increases their global competition while TSMC’s focus broadens their niche monopoly in manufacturing. To bring back the analogy, TSMC is like Wise (niche focus) while Revolut is like Samsung (many services with vertically integration). I digress…

Nium (previously Instarem):

This private company offers a modular platform for global business payments (not consumer facing), supporting 100+ currencies and SWIFT connectivity. They frequently offer cheaper transfers then Wise for smaller sums. They increased revenue up to $120M in 2024, a 50% increase. In a June 2023 interview with CNBC, their CEO said that they would be profitable in the next 3-4 quarters (by 2024) and IPO in 2025. It seems that his 2023 forecasts have not materialized, they are still not profitable and have pushed their IPO out to 2026. Furthermore, it is unclear how much of their growth is organic, as they have engaged in a series of acquisitions over the last few years (Ixaris, SoCash, Wirecard Forex India). I am skeptical.

Atlantic Money:

The claim to fame for this startup is offering a flat rate of only £3 for currency transactions, regardless of the amount (up to £1 million). This clearly makes them the lowest cost provider for large transfers from the UK. After launch, it enjoyed rapid growth rate of 100% volume increase in just 6 months. However, they remained a smaller player with just 10,000 customers. Filings with the UK government indicate they lost about £700,000 in both 2022 and 2023. I am not sure that their business model is feasible. The company was acquired by payroll firm “Deel” in 2024.

Thunes:

A private company focused on business cross-border transactions, particularly in developing markets (132 countries, 85 currencies). This service appears analogous to Wise Platforms, but more focused on payment transactions. They partner with local payment providers in one country (ex: digital wallets, super apps, banks) and connect them with preferred providers in another country. Thunes facilitates interoperability between payment providers including Visa, Paypal, MoneyGram, Payoneer and other fintech like Revolut/Remitly. In terms of volume, they processed $18B in 2024 which is a much much smaller than Wise’s $152B. I could not find clear information regarding their pricing and fees. In 2024, they are apparently approaching profitability and have $100M in annual revenue.

In a 2020 interview, the CEO of Thunes compared himself to Wise:

“Thunes differentiates by focusing almost exclusively on emerging markets, where the barriers to entry are high. TransferWise (Wise) theoretically is a competitor, but it doesn’t serve as many markets as Thunes, and is also a potential client for Thunes’ technology.”

Interactive Brokers (IBRK):

I have read on some forums that expats use Interactive Brokers to convert large sums of money into other currencies. Currency exchange is close to free on IBRK for trading purposes. However, I don’t see them as actual competition for Wise. Conducting these exchanges on IBRK and withdrawing them immediately will get your account banned, as they are intended for trading and not for cross-border transfers. They offer cheap currency conversion as a loss leader in order to facilitate trading. Furthermore, IBRK has actually partnered with Wise to broaden the number of currencies that they can accept into accounts for trading. IBRK is a friend, not a foe.

Stablecoin - Mania or Disruption?

There has been a lot of hype surrounding stablecoins recently and they have been proposed as an alternative way of transferring money across borders. Since most cryptocurrencies are too volatile to be used as a regular currency, stablecoins are blockchain-based currencies that are pegged to a more stable asset (like US dollar). Some popular stablecoins and corresponding issuers are USDC (Circle), USDT (Tether) and BUSD (Paxos) and PayPal USD (PYUSD). Tether is the largest issuer and holds a massive $118B in U.S treasuries as collateral. These issuers make a profit from interest on their collateral assets and benefit from higher interest rates.

Transferring a stablecoin from one person to another incurs minimal cost. An FX exchange system with stablecoins would involve the following: crypto-wallet provider converts local currency into stablecoin, stablecoin is then transferred to another recipient (regardless of the location) for negligible costs, the stablecoin is then converted to a different local currency.

While such a system could be more efficient than the legacy SWIFT network, I don’t think it is competitive with Wise’s network as you are essentially adding an additional digital currency variable to the FX process. The only situation where a stablecoin-based process would be cheaper is if there was no currency conversion at all, if everyone gave up fiat currency worldwide and only accepted stablecoin. I am skeptical. There are multiple problems with stablecoins:

Financial stability: Customers must trust that the stablecoin will represent the actual underlying asset (USD for example), as they are trading in their real government-issued money for a digital proxy. As an example, in 2023 USDC (Circle) was briefly de-pegged from the USD after Circle struggled to retrieve funds from the failing Silicon Value Bank. A mass sell-off or loss of trust in a stable-coin issuer could destabilize markets.

Sovereignty: Governments in large economies would likely prevent the mass adoption of a USD-based stablecoin, as they would effectively be giving up sovereignty over having their own local currency. Imagine India allowing everyone to switch over to USD-based stable coins and give up Rupees. Stablecoins might be preferred by weak economies with hyperinflation, where switching to a USD-proxy currency might be preferable to their current situation.

Fragmentation: Due to concerns about sovereignty, there are likely to be many different stablecoin providers. Here is a long list of the top stablecoins currently. The barrier to issuing a stablecoin does not appear to be restricted to banks, PayPal launched their own version in 2023. It is unclear how interoperable different stablecoins will be with each other. If they are not interoperable, then crypto-currency conversion will start to resemble fiat currency conversion which defeats the purpose.

There need to be mechanisms to prevent illicit payments, money laundering and fraud. These types of controls are part of the reason the SWIFT network is expensive in the first place.

Wallet security needs to be high.

If we assume fiat currency is here to stay, then the costs of performing a cross-border transaction are higher than they appear. When Wise moves money they are conducting a multi-step process including initial verification, moving the money, converting the currency and then off-ramping the money into a recipient bank. Besides moving the money, stablecoins must outsource all these other services which incurs additional fees (this post has an example of the costs of a USDC to CAD transfer).

The CEO of Wise was blunt when asked about stablecoins during the last earnings call:

“I can’t - every time there is a crypto or stablecoin question, I think our opinion hasn’t changed, that if we see something that enables the movement of funds faster, cheaper and more conveniently, we will totally consider that… But we also have nothing to report that we would have seen anything interesting.”

Final Thoughts:

The business of cross-border money transfer is lucrative and remains fragmented. Over time, network effects and economies of scale are likely to leave only the largest players standing.

I would group Wise’s competitors into 3 categories:

Legacy banks and older transfer providers like Western Union. They can’t compete with Wise on cost.

Fintechs which can sometimes compete on cost (even occasionally offering lower fees), but can’t operate in a profitable way. Subsidizing your conversion costs for customers is not sustainable over the long run. There is only so much money investors will let you burn through. Many fintechs lost their initially impressive revenue growth after years of negative income (ex: TransferGo, Azimo and WorldRemit/Zepz). HSBC launched it’s own venture called Zing which was offering cheap 0.2% fees, then it was forced to shut it down only 1 year later. It is not easy to be build a cost-effective network that is sustainable.

Stablecoin - We must assume the entire globe will be adopting a few stablecoins to conduct all transactions and get rid of fiat money. This theory involves a lot of speculation. If we keep fiat money then the FX process with stablecoins is inferior to the existing Wise network, which is already approved by regulators and fully functioning.

Although the future is hard to predict, I see Wise as the long-term winner in this lucrative industry. I believe it will become a winner-take-all industry. By September we should have public earnings reports from some of the other UK fintechs for 2024 including Revolut and Atlantic Money.

I’ll end the article with a quote from Wise’s CEO when asked about competition:

… When we think about building the moat, we build a moat against incumbents, make it harder for them to catch up on the infrastructure. We kind of replace the rails. But we also actually compete with the companies that don’t exist yet. And that’s maybe even the more important part of the moat.”

Management is talking about building “moats.” This is what value investors like to hear.

Thanks for reading!

- Stock Doctor

Disclosure: I have a small position in WISE and may add more over the next few months.

Disclaimer: This article is intended for informational and educational purposes. This is not financial advice. Investors should always do their own due diligence.

One thing I don't understand is that if the legacy banks (scaled) have such a big profit centre in forex and this is a good business for them, why aren't they willing to cut the rates? I appreciate that there is more cost associated with the correspondent banks, but even then they are still taking a fat spread on top. Any thoughts?

Great overview, thank you!